- THERE ARE ONLY 3-MEASURES THAT CAN HELP FIGURE OUT WHAT'S GOING ON, AND THEY ARE GOLD, E-CURRENCIES AND LABOR.

- EVERYTHING ELSE LIKE PAPER GOLD, STOCKS, YIELDS OVER PONZI CURRENCIES, COMMODITIES IN PONZI CURRENCIES, EXCHANGE RATES ARE MOVING TARGETS AND MAKE NO SENSE.

ALERT OF JULY, 31ST No.3568 24 Hour False Flag Alert (A Deep State Attempt to Deflect From News Damaging to Their Narrative) Q !! El Paso mall

Recession Countdown Begins: Treasury 2s10s Yield Curve Inverts For First Time In 12 Years; 30Y Yield Drops To All Time Low

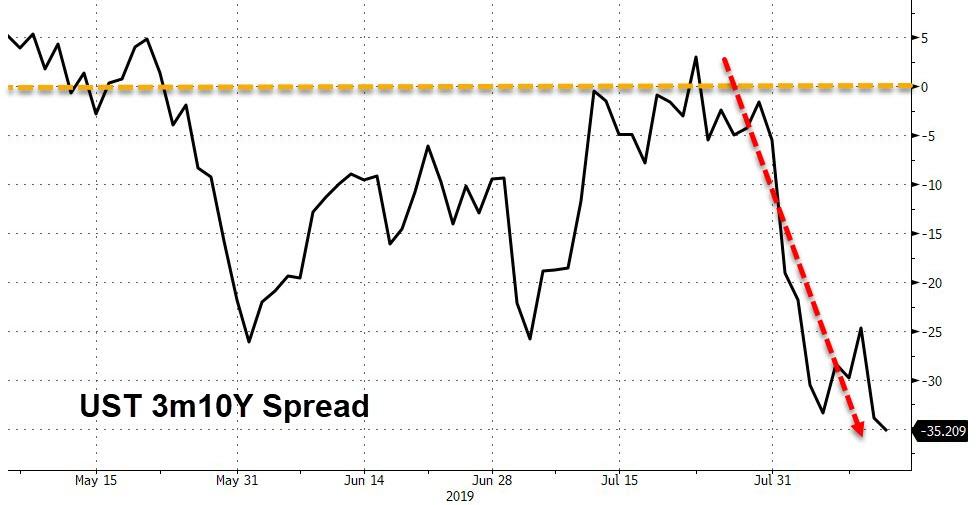

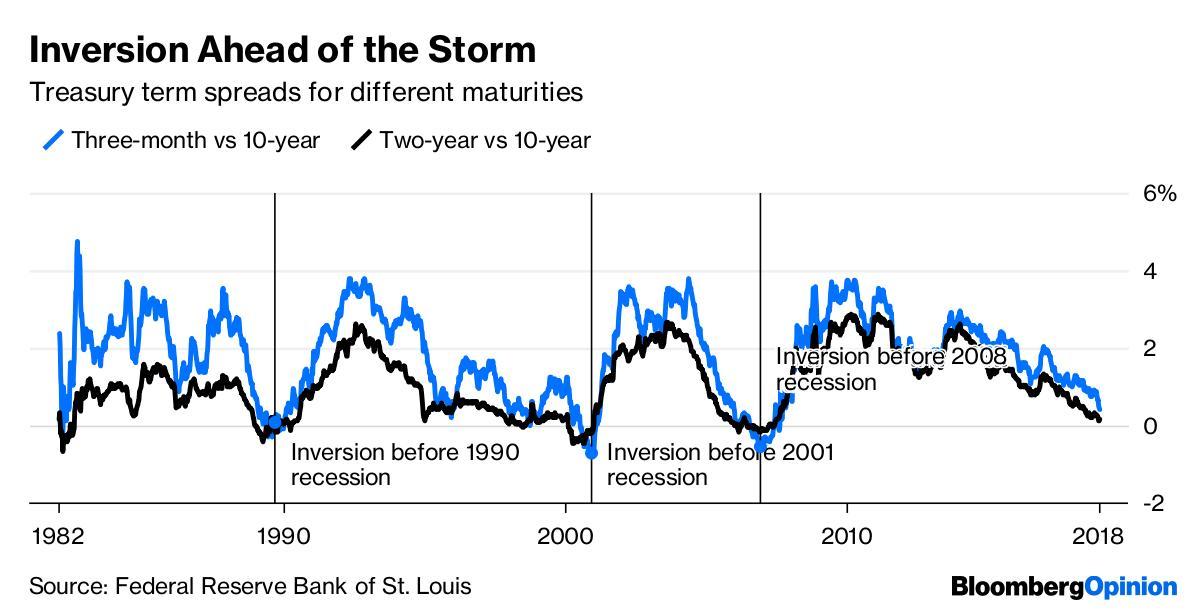

While many have noted the inversion of the 3m-10Y segment of the US Treasury curve, mainstream investors appear more focused on the spread between 2Y and 10Y yields... and

The spread between 3m and 10Y yields has been inverted since mid-May and reached its most inverted since April 2007 this morning...

Source: Bloomberg

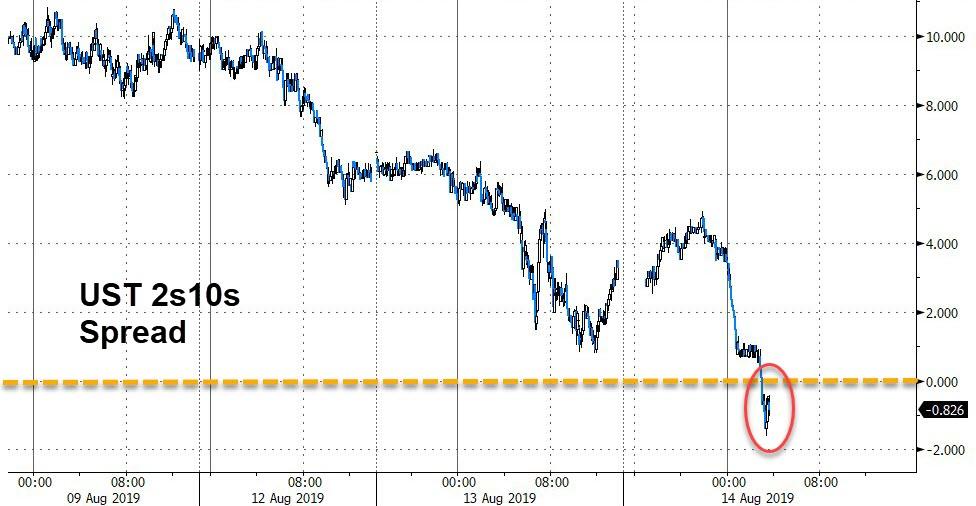

But now, the 2Y-10Y spread ha collapsed into inversion...

For the first time since May 2007...

All major segments of the curve are now inverted

With 30Y below the EFF...

And 30Y at record low yield at 2.05%, down 10bps overnight...

The strongest recessionary signal yet, and equity markets appear to be waking up what this all means...

Source: Bloomberg

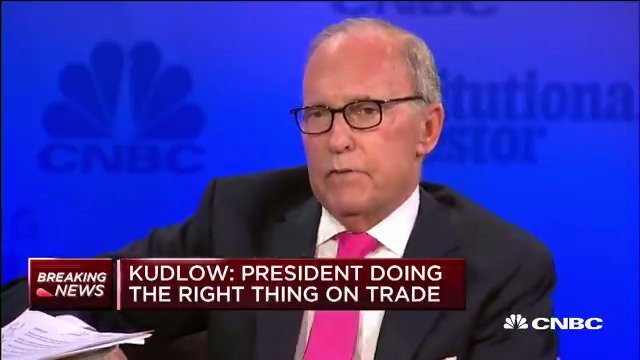

Here is Larry Kudlow last summer explaining that everyone freaking out about the 2s10s spread is silly, they focus on the 3-month to 10-year spread that has preceded every recession in the last 50 years (with few if any false positives)... ( fwd

"reading the spread wrong," Larry Kudlow says of the flattening yield curve. "There's no recession in sight right now." #DeliveringAlpha cnb.cx/2zOaKgh Actually we're

37 people are talking about this

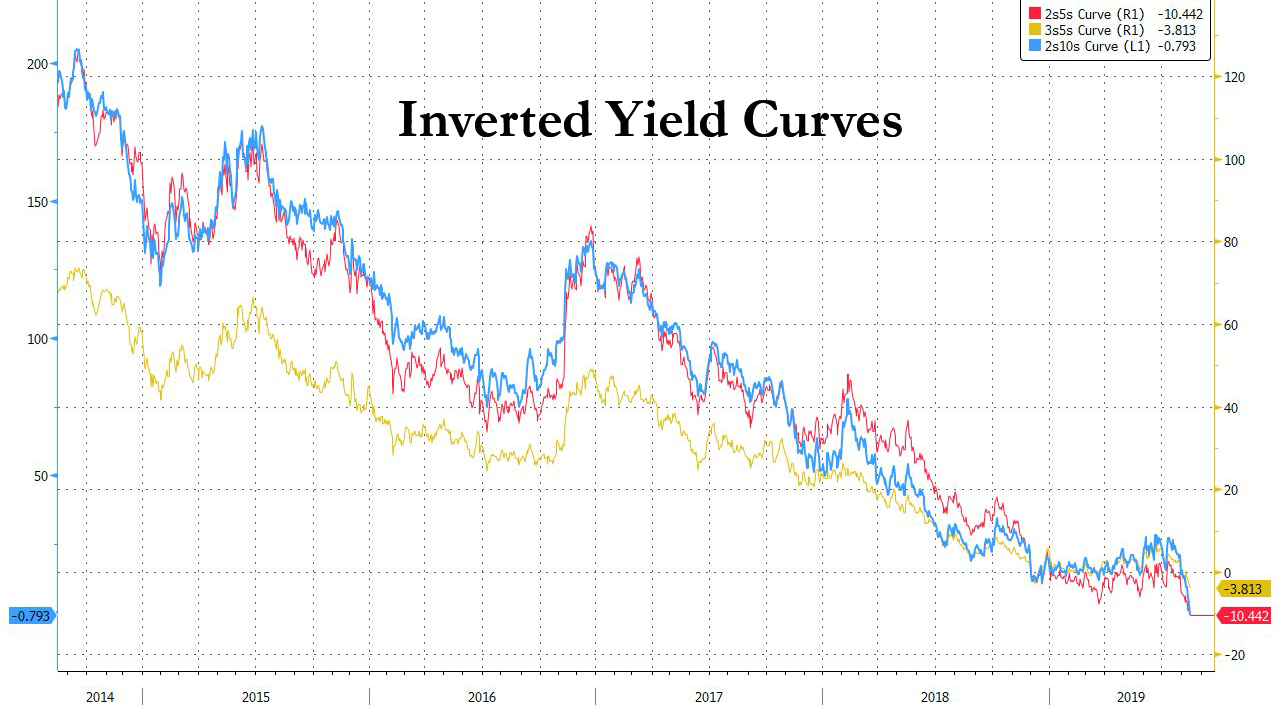

And here is Bloomberg showing in

Critically, as Jim Grant noted recently, the spread between the 10-year and three-month yields is an important indicator, James Bianco, president and eponym

Finally, Joseph Carson, former Director of Global Economic Research, Alliance Bernstein, notes that recessions are far from being alike and their symptoms and causes differ over time. Despite its many shapes and sizes the historical regularity that an inverted Treasury yield curve has coincided with recession

The power of the term spread to predict or anticipate economic recessions needs to be respected, but there are several new domestic and global factors that are present today, suggesting that the signaling effect from changes in the Treasury yield curve directly to the economy's future performance might not be as robust as it was past periods.

First, this is the first economic cycle that involved a bond-buying program by the Federal Reserve. The quantitative bond-buying program produced a technical anchoring effect at the long-end of the bond market that was not present in prior cycles. While this program did not cause a yield curve inversion by itself it did result in a flatter yield curve than what otherwise would have been the case, and as a result, it would not take much force from other factors to trigger an inversion in the term spread of yields.Second, given the increased globalization of the financial markets the appeal and demand of long-dated US Treasury securities is often based on the yields available in other major economies. Long bond yields in a number of major economies (and France) are negative and many others (including the UK, Spain and Australia) are below 1% and that has led to an increase in global demand for long-dated US Treasury securities since yields in the US are in some cases 100 to 200 basis points over the yields of comparable maturities in other economies. That increased global demand for US securities is a new technical factor and unrelated to the performance of the US economy. such Germany, Japan Third, this is the first time the inversion of the Treasury curve occurred with nominal yields at the short and long end that were well below the growth in nominal income and GDP (or the economy's yield curve). Why is that important? There is a direct negative consequencethe economy's performance when the cost of borrowing exceeds the growth in nominal income. At that point, the cost of new borrowing starts to become too costly, leading to a slowdown or a decline in credit use, and a weaker economy. to Although it is often overlooked, all of the Treasury yield curve inversions that have preceded recessions have coincided with an inversion in the economy's yield curve, or when short and long-term nominal rates were above the growth in nominal income and GDP. The fact that the Treasury yield curve has inverted at relatively low nominal yields, suggests that the interest rate channel is not producing the restrictive influences on the economy as it did during prior inversions and instead is actually providing a cushion (or stimulus) to the economy.should take note of this unusual occurrence and not rush to ease policy further, saving its interest rate powder for another time. Policymakers

If the Treasury curve inversion is not producing a restrictive influence on the economy as it did in the past can the US still experience a recession? Yes, but it would come from different channels.

The biggest recession risk today centers around the trade dispute between the US and China. Trade disputes have the potential to be very disruptive and contractionary

Of all of these channels, the biggest vulnerability for the US is the equity channel since the market value of equities relative to income and GDP is at record highs, providing consumers with vast sums of liquidity and wealth. If the imposition of new tariffs and the uncertainty over what may follow triggers a de-risking and rush to exit, sparking a sustained 25% to 30% correction in the equity market that by itself could trigger a recession as it would deal a substantial

That is not a forecast or a prediction but

- ALERT: THE DEEP STATE WILL ATTACK WITH ECONOMICAL CHAOS, (TRADE AND CURRENCY WARS) MILITARY BLOCKADES, SANCTIONS, BOYCOTTS, SIEGES, BLACKMAIL, SHOOTINGS, BLACKOUTS, SUICIDES OF SPECIAL PRISONERS, ASSASSINATIONS AS DEEP STATE PUPPETS FACE PROSECUTIONS, INDICTMENTS (GUILHOTINE), AND PRISONS FOLLOWING THE FISA-RUSSIA (BRITISH) GATE FIASCO, EPSTEIN BOOBY HONEY TRAP AND FAILED COUP D'ETAT AGAINST TRUMP.

- Q!

! [

Be vigilant.

See something.

Say something.

Know your surroundings at all times.

Q - SKY OVER OHIO ON 4TH AUGUST, 2019.

CLINTON DEATH COUNT

No comments:

Post a Comment