or reload the browser

or reload the browser

THE OVERTHROW OFWEIGHTS AND MEASURES IS CHAOS WEAPONIZED. 1. Bring and restore all mining under the People’s Treasury. 2. Bring all Human Energy (Labor) under the people’s Treasury. 3. Then issue overnight currency supply ballasted on current production, in accordance to the ancient law and root value of “Weights AND Measures.” 4. MINING, ballasted in Bonds, future production. 5. TAX-EXEMPTED CENTRAL BANKING SCHEME IS IMITATION CAPITALISM. 6.2022.7.26. RUSSIA/CHINA HEAD IN THIS DIRECTION!

Authored by Robert Aro via The Mises Institute,

Imagine if a member of the Federal Reserve’s Board of Governors said the following :

“When governments manipulate exchange rates to affect currency markets, they undermine the honest efforts of countries that wish to compete fairly in the global marketplace. Supply and demand are distorted by artificial prices conveyed through contrived exchange rates.

Or something honest like:

Yet below, we can see everything wrong with the Mainstream Media (MSM), mainstream economists, and American politics starting with theNew York Times article entitled, God Help Us if Judy Shelton Joins the Fed. Former counselor to the Treasury secretary during the Obama administration, Steven Rattner began with :

Trump’s latest unqualified nominee to the Federal Reserve Board must be rejected.

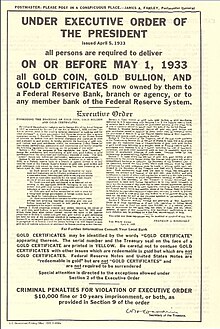

The defaming article shows Mr. Rattner has no care nor understanding of economics. According to him, Ms. Shelton is known for taking “long-discredited positions in the monetary system,” referring to the gold standard, as he claims it was the “culprit in deepening the Great Depression.” Clearly he is no fan of (or perhaps isn’t educated enough to have heard of) Mises or Rothbard.

In what some may described as laudable on Ms. Shelton’s behalf, Mr. Rattner, fueled by ignorance, continues:

Among other heretical stances, she has supported the abolition of the Federal Reserve itself, putting her in a position to undermine the very institution she is being nominated to serve.

A similar tone was found in the National Review, a magazine which defines itself using the highly nebulous and ill-defined “modern conservative movement.” Going back several months the “controversy” surrounding Judy Shelton was shared in an oxymoronic write-up called: The Wrong Kind of ‘Intellectual Diversity’ at the Fed. It is nothing more than a rant showing the senior editor also knows little about history or economics, but being in a position to publish, does so with a vociferous opinion. He begins with the usual appeal to popularity:

First, she has been a single-minded advocate of a policy that most economists rightly reject: the revival of the gold standard.

What is popular is not always true, especially regarding economics. The article cites quotes from 2009 to the Wall Street Journal in an attempt to discredit her by showing she has not always been consistent in her stances over the span of the past decade. By contrast, the rant implies all other members of the Fed and economists have.

Unfortunately, some people claim to like diversity, but not when it’s different from their own bias. The senior editor who wrote the hit piece can be found on twitter.

Unlike the New York Times and National Review, surprising as it may seem, CNBC’s position was more neutral when discussing the senate hearing, noting :

She faced persistent and at-times hostile questions about her support for the gold standard, her beliefs on whether bank deposits should be insured and whether the Fed should be independent of political influences.

Last but not least, the Wall Street Journal wrote it best , much to the chagrin of its rivals:

the news write-ups inevitably described her with adjectives like “controversial.” She should take it as a badge of honor, given how she would provide needed intellectual diversity at the Fed.

Only in a world this backwards where, in a supposed free country, socialism is considered good and capitalism bad that Shelton could receive so much scorn. To think, 1 out of 7 members of the board could have ideas other than inflationist dogma but they would be shunned for speaking up, says a lot of the society in which we are living. Perhaps the real reason is, if appointed, it could set Judy Shelton in line to the position of Federal Reserve Chair?

Ironically enough, as long Congress stays partisan, we may see her in one of the most powerful central banking positions in the world. It won’t “End the Fed” overnight, but maybe it’s one step closer!