As Dow Plunges 600 And Gold Surges $30, This Is Truly Amazing

With the Dow plunging 600 and the price of gold surging $30 to $1,470, this is truly amazing.

Truly Amazing

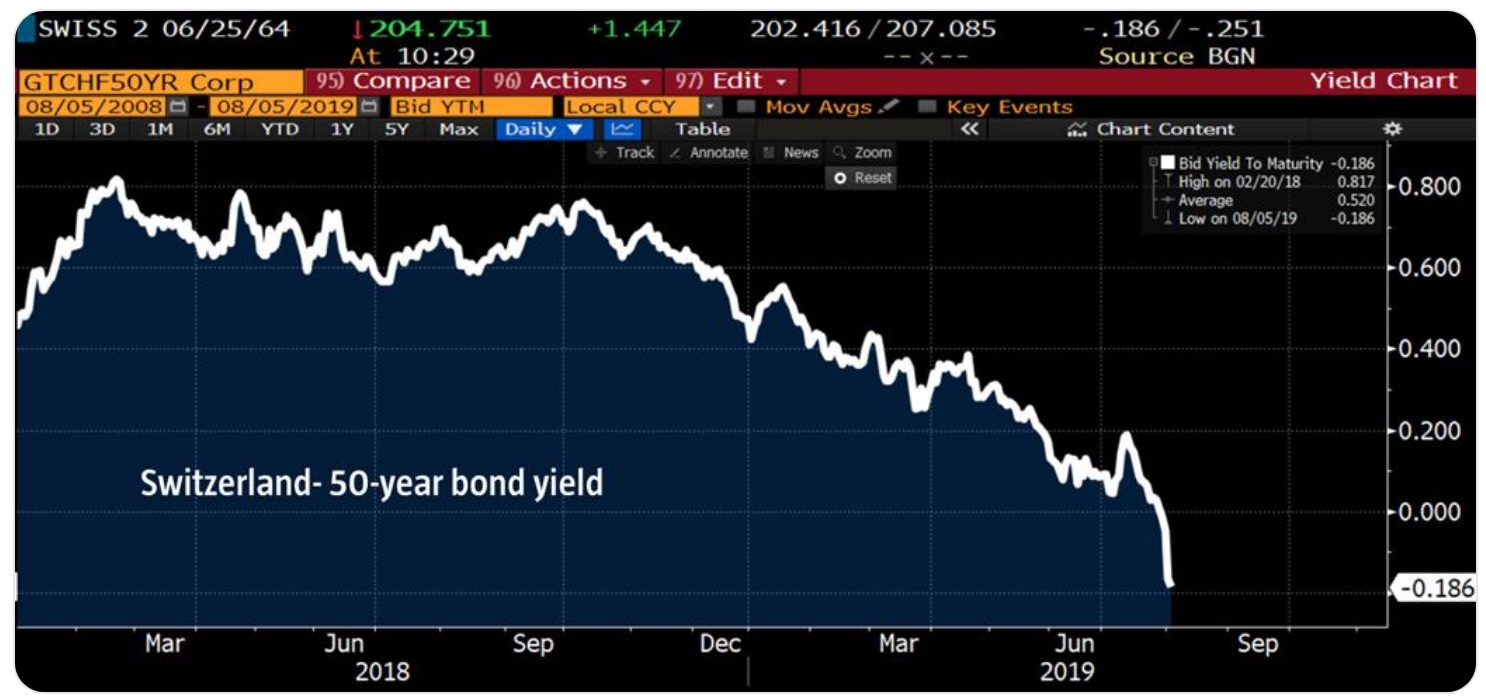

August 5 (King World News) – Jeroen Blokland: “Truly amazing! Switzerland’s 50-year bond yield is now down to almost -0.20%… (see below).

August 5 (King World News) – Jeroen Blokland: “Truly amazing! Switzerland’s 50-year bond yield is now down to almost -0.20%… (see below).

AMAZING: Switzerland’s 50-Year Bond Yield Approaching -0.20%!

If Things Turn Really Ugly

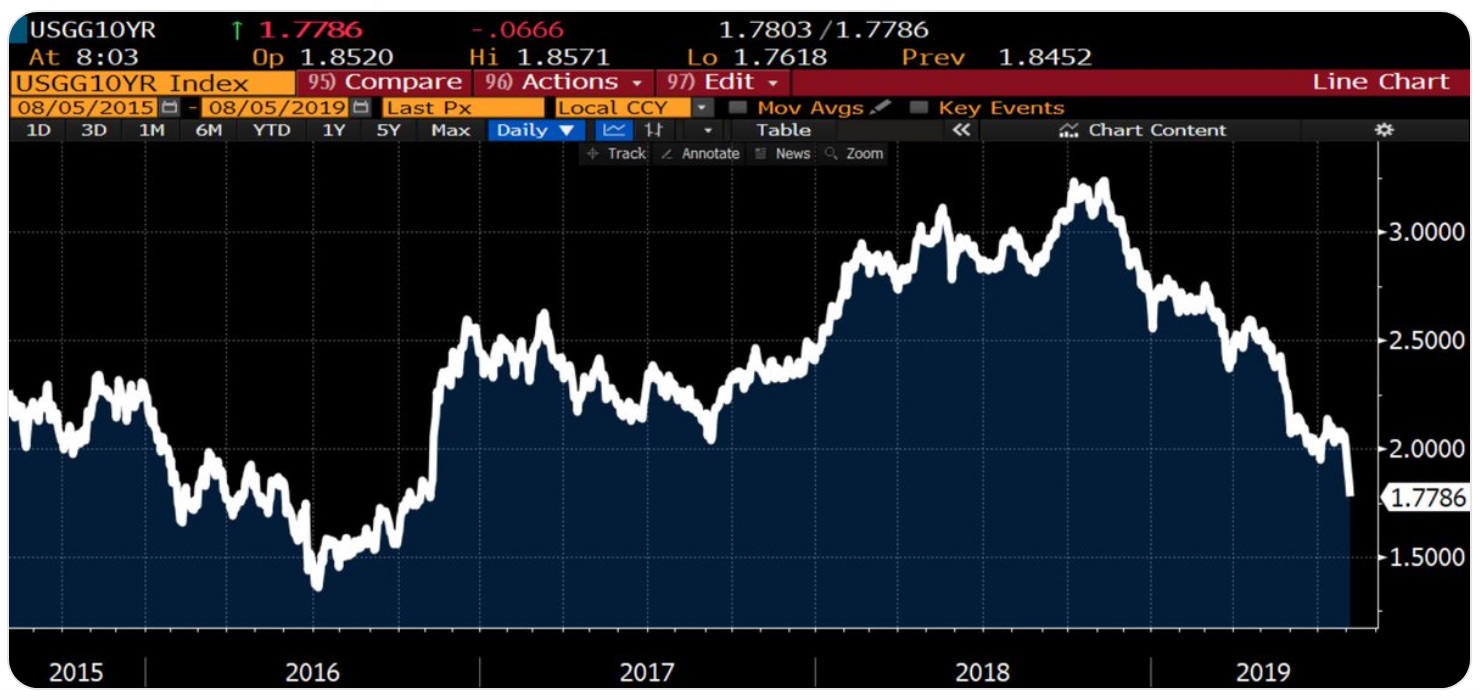

Jeroen Blokland: “US 10-year Treasury yield sinks to 1.77%,lowest since November 2016! All-time low is 1.32%. We could get there quickly if things turn really ugly. ( See below).

Jeroen Blokland: “US 10-year Treasury yield sinks to 1.77%,

US 10-Year Treasury Yield Collapse Continues

Owning Gold & Silver Is The Right Thing To Do

Peter Boockvar: “So now we have a trade situation that is going off the rails as the side effects multiply due to the ramping up of the use of tariffs and we are only further apart from any resolution with the Chinese. The policy of using tariffs as a tool to address our legitimate beefs with the Chinese has failed miserably. We are approaching a year and a half when tariffs on washing machines and solar panels were first implemented and to what gainwith all of this? If the administration was trying to calm things by sending Peter Navarro on Fox Sunday, he only made it worse. The selloff in the Chinese yuan now creates a whole new set of issues and while capital flight is now a real concern in China, and certainly for Hong Kong, we all lose by what is going on.

Peter Boockvar: “So now we have a trade situation that is going off the rails as the side effects multiply due to the ramping up of the use of tariffs and we are only further apart from any resolution with the Chinese. The policy of using tariffs as a tool to address our legitimate beefs with the Chinese has failed miserably. We are approaching a year and a half when tariffs on washing machines and solar panels were first implemented and to what gain

And if you think Fed rate cuts are going to somehow cushion this, please reassess as they won’t …

IMPORTANT:To learn which junior explorer is using Artificial Intelligence to select drill targets looking for one of the largest gold discoveries world CLICK HERE OR ON THE IMAGE BELOW

Sponsored

Sponsored

Sponsored

Sponsored

The Fed is now irrelevant in terms of their ability to lift economic growth and markets I believe. If anything, if the Fed goes down the path of the ECB and BoJ, it will only make it worse. Thus, after only helping to inflate P/E multiples I’ll argue that the stock market from here will NOT be trading off what the Fed is going to do next, it will be all about where the economic fundamentals go from here. Good news will be good news, bad news will be bad news. You certainly are aware where the Nikkei is today versus where it was in 1989 after all the BoJ easing. Do you know that the Euro STOXX 600 is below where it was in 2000 even after all the ECB monetary madness?

I’ll repeat again my belief that owning some gold and silver is the right positioning to have under the current circumstances.”

“They’re Too Long The Dollar”

Peter Schiff: “People don’t own gold and silver. They’re too long the dollar. They have no idea just how much inflation the Fed is going to beunleashing . And it’s not going to be good for stocks. Inflation is going to be in the supermarket, not in the stock market.”

Peter Schiff: “People don’t own gold and silver. They’re too long the dollar. They have no idea just how much inflation the Fed is going to be

The KWN audio interview with Egon von Greyerz has now been released and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

The Collapse Will Be Epic

READ THIS NEXT!Greyerz – Most People Don’t Understand The Scale Of The Collapse That Is In Front Of Us CLICK HERE TO READ

READ THIS NEXT!

More articles to follow…

In the meantime, other important releases…

Time For Some Good News, Uh-Oh, And Wrong Turn CLICK HERE TO READ

Egon von Greyerz KWN Audio Now Released! CLICK HERE TO READ

Look At The Latest Bullion Bank And Commercial Short Positions In The Gold & Silver Markets CLICK HERE TO READ

Gold & Silver Continue To Shine As Theater Of The Absurd Continues, Plus Tom McClellan On Stock Market Reversal CLICK HERE TO READ

No comments:

Post a Comment