It was back on August 6, in an article titled "Forget China, The Fed Has A Much Bigger Problem On Its Hands", where we explained why in response to the coming dollar funding shortage and liquidity crunch (we warned about this month's repo

In any event, virtually no 'serious' Wall Street analyst predicted that QE would be on traders lips in the immediate future, and certainly nobody predicted the coming "dollar funding storm", which we warned readers about just last Friday.

Fast forward to today when one repo expend

Just please don't call it QE.

Let's start with Nomura's rates repo

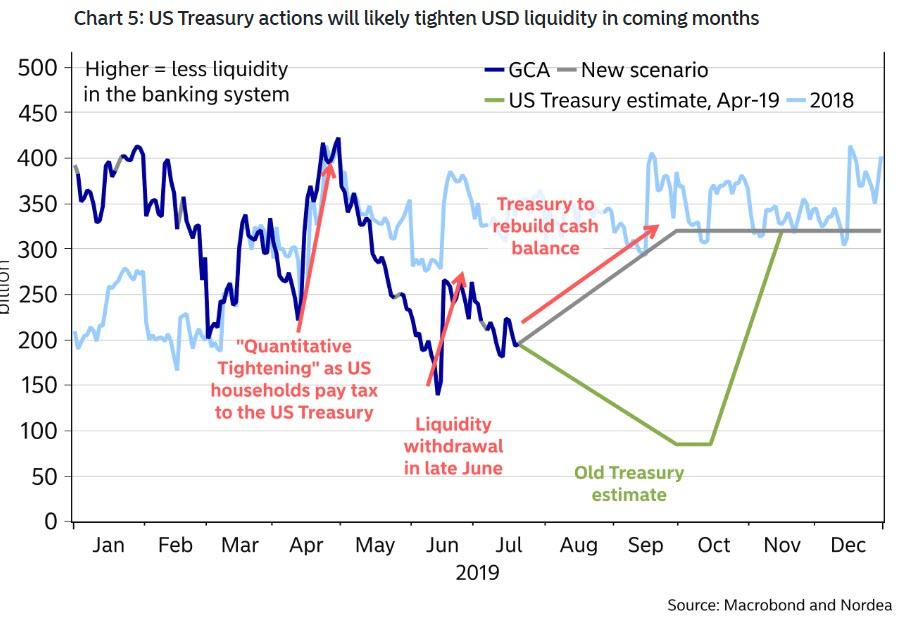

As Nomura further notes for those who missed our justification for the recent sharp drop in reserves, "with the asset side of the Fed’s balance sheet fixed, the recent declines in reserves have been driven by increases in the Fed’s non-reserve liabilities, primarily the Treasury General Account (TGA), currency outstanding and deposits held by foreign official institutions." Additionally, the Japanese bank estimates that yesterday the Trasury's cash balance at the Fed went up by $60-100bn, due to the regular pattern of corporate tax payments, and concludes what is by now apparent to everyone "the decline in reserves driven by these increases in the Fed’s other liabilities had an outsized impact on funding markets."

Why does this matter? Because it all comes as the Fed is determining how far they should let reserves fall, among other key things, such as how far should the Fed let rates drop.

Some more details: Reserves reached $2.8tn in late 2014 when the Fed stopped expanding its balance sheet and they were $2.2tn when, in late 2017, the Fed decided to begin to let its growth

Meanwhile, pressures repo

With all that said, and given recent events, Nomura now expects Chair Powell and the FOMC to say something about their plans for the balance sheet at the conclusion of this week’s FOMC meeting, where the bank sees four options:

- The FOMC and/or Chair Powell could simply state that the FOMC will conduct short-term

repo - The FOMC could say they they will start to expand the Fed’s balance sheet as soon as practicable, in line with the growth of the Fed’s non-reserve liabilities. If the FOMC makes this

decision it is likely - The FOMC may again lower IOR relative to the top of the federal funds target range, in an effort to keep the fed funds rate well within the FOMC’s target range.

- The FOMC could announce they they are launching a new standing

repo

While Nomura generally four as most

The second option – announcing that they will start to expand the balance sheet in coming weeks – also seems likely.would not be hard to implement. The New York Fed is already purchasing assets to offset the runoff of its existing Treasury and MBS securities. It would be relatively simple to expand the size of those purchases to take account of increases in other liabilities. The Treasury’s Operationally it for their cash balance will likely continue to put downward pressure on reserves in coming weeks and we expect the level of reserves to reach $1.3tn by the end-September, or sooner. Moreover, the pressures that affected funding markets in the last few days may be an indication that reserves have fallen “enough.” plans

And so, at least one bank thinks it is "likely" the Fed may announce permanent open market operations, i.e., regularly scheduled bond purchases to inject market liquidity. Nomura is not the only one.

In his latest installment analyzing the impact of tumbling reserves, BofA's Mark Cabana, who was probably the most ahead of the Wall Street curve on this topic, also presents his personal views as to what caused the recent spike in repo baking

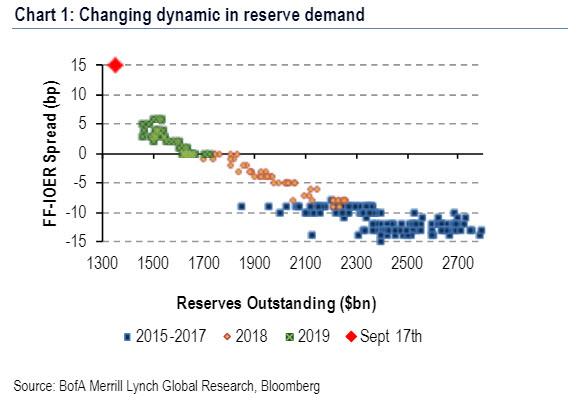

Cabana also points out that whereas before the crisis zero excess reserves were perfectly sufficient in a world where banks regularly used the Fed's discount window, that is no longer the state of play, largely due to regulatory and liquidity requirements, and as a result with funding pressures rising as reserves have declined to ~$1.35tn suggests that the market is on the upward sloping part of the reserve demand curve, below the minimum amount of reserves needed for an "abundant reserve regime."

The repo buy

With repo repo repo

Which brings us to Cabana's punchline

Echoing Nomura, the BofA strategist predicts that at today's FOMC meeting, "we see risks the Fed indicates they intend to stabilize the level of reserves in the system. This is not our base case for now but

How much "bond purchases" would the Fed announces? The answer is not far off the $400BN we extrapolated based on the chart above:

"The Fed will likely need to purchase $250bn in assets in the secondary market to return to an "abundant" reserve level plus a buffer, and will need to continue outright purchases of ~$150bn/yr to maintain this reserve level. Reserves declined ~$100bn at the start of the week and the banking system appears to have reached the upward sloping part of the demand curve with this. drain

There's more, literally.

As Cabana then adds, the Fed will also likely want to maintain a buffer above this "abundant" level. here bn

Then, to maintain reserves at "abundant" levels, the Fed will need to continue outright purchases to meet growth in demand for their liabilities. This demand comes from:

- Currency in circulation - which grows with GDP. Fed surveys show the median growth expectation at 4.9% per year.

- Bank HQLA - reserves fulfill HQLA needs of banks and should growth with bank balance sheets.

- Treasury cash balance - which is based on expected five day outflows and should grow with the deficit.

- To meet this demand for their liabilities, we estimate the Fed will need to purchase ~$150bn in USTs per year.

In sum, and confirming what we said above, the Fed's purchases could be $400bn in the next year, according to BofA, which would be front-loaded with a $250bn purchase now, and annual run-rate of $150bn.

Oh, and for those wondering what the Fed will purchase, here is the answer:

We expect purchases will occur across the curve, to reflect the distribution of USTs outstanding (which is how they currently purchase) and most likely only in USTs. The Fed could front-load these purchases at the front end of the curve to exert a larger impact onrepo , but may not want to deliberately steepen the curve and tighten financial conditions while lowering interest rates. Purchasing across the curve would also be consistent with how the Fedoffset currency growth via "coupon passes" prior to the crisis. We acknowledge there is lots of uncertainty on this question.

Needless the say the market reaction would be instant, with "richening of yields across the curve, especially in the long end" if the Fed announces outright UST purchases as now appears to be consensus .

Finally, completing the trifecta of strategists expecting the Fed to launch QE open market purchases, is Morgan Stanley strategist Matt Hornbach, who said that "the Federal Reserve is likely to announce permanent open market operations in its communications Wednesday. "

Speaking in an interview on Bloomberg TV, the rates strategist said that this step would allow the Fed to address the funding market’s strains without stoking fears of a systemic problem or fueling talk of a recession. Echoing what Cabana said above, Hornbach agrees that "the buffer of reserves that the Fed was hoping to have in the system clearly isn’t there any more."

Ok... but won't a restart of QE trigger PTSD flashbacks to 2009 and the financial crisis, and telegraph to the world that the US is in a recession? Well, this is where semantic comes into play, because when is QE not QE? Or when is debt monetization not debt monetization? Or when is state financing not state financing? When it is something else. And here is where the magic of narratives come in.

As Hornbach writes, "POMOs will help the Fed avoid the implication that it’s restarting QE, which could raise suspicions of a bigger economic threat."

Wait, wait, wait... Isn't POMO, i.e. permanent open market operations precisely the way one implements QE? After all, even Cabana above admits the Fed will need to expand its balance sheet by up to $400BN in the very short term to normalize financial conditions? Apparently, to Morgan Stanley, the answer is no.

"When you start losing control of the target rate, you need to increase reserves in the system, but that’s not necessarily QE as we know it in a traditional sense. They’re going to do this via permanent open market operations."

Oh, so it's not QE... it's just what the central bank does when it implements QE. Thanks, Matt, I think we got it.

Watch his entire interview, and much more below.

Besides the staggering implications for capital markets from a return to QE, what all of the above means is that Wall Street now expects the Fed to not only cut rates, but to launch QE... pardon , start permanent open market operations (also known as QE). This also means that the bar is suddenly much lower for the Fed to disappoint consensus Wall Street , and trader, expectations because if Powell merely commits to a 25bps cut with no follow through, and says nothing about a standing repo facility and/or POMOs, the market will be extremely displeased, and the result will be not only a violent drop in risk assets, but a blow out in funding levels to new all time highs.

The combination of those two taking place at the same time could just be the catalyst that culminates in the next market crash, unless of course the Fed yields to Wall Street demands for even more liquidity, and stocks soar to new record highs on the back of rate cuts and QE at a time when the US economy is firing on all cylinders.

One final fringe benefit: president Trump will be very happy and Powell will keep his job for at least a few more months.