dd

Fed Impotence Exposed: TSY Yields Are Collapsing, Dow -1400Pts From Post-Powell Highs

The Fed cut rates and the market dropped.

Time for the Fed to go full Costanza and raise rates.

101 people are talking about this

It seems an emergency rate-cut of 50bps has done more to damage confidence that rebuild it... "what do they know?"

Did The Fed get an early glimpse of this week's payrolls data?

The Fed rate cut was unnecessary and panicky. It can’t fix the virus and won’t fix the market or economy.

107 people are talking about this

The Dow is down 1400 points from the post-Powell rate-cut spike high...

The S&P and Nasdaq have broken back below key technical levels...

And bond yields are crashing... with 10Y Yield breaking below 1.00% handle for the first time ever...

2Y-10Y yields are down over 22bps across the curve and 30Y down 15bps...

Gold is soaring back towards recent highs...

Dan Ivascyn, group chief investment officer of Pacific Investment Management Co., said in an email Tuesday:

“Rate cuts don’t stop virus spread. May help support risk assets shortterm but highly imperfect solution to what is ultimately a health concern.”

We wonder what Powell and Trump are thinking?

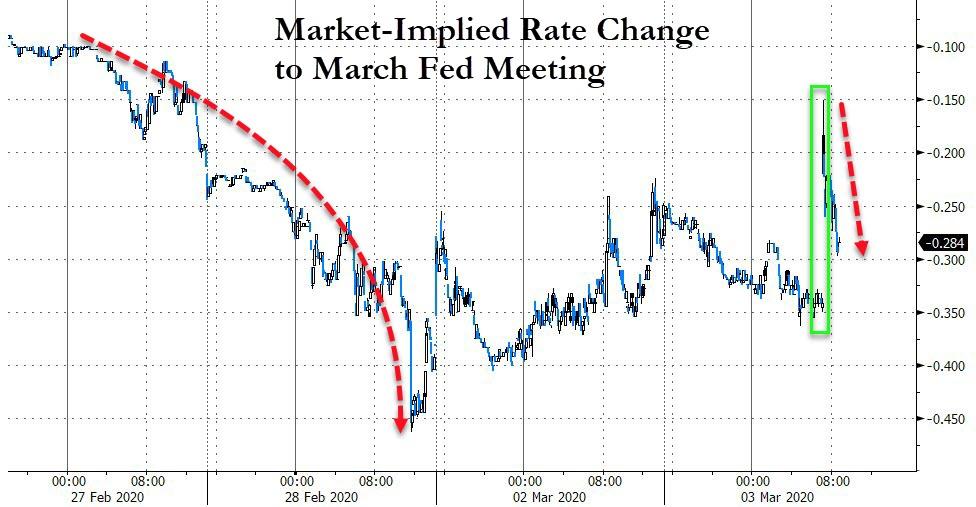

One thing is for sure, the market is not satisfied - it is now demanding at least another 25bps cut in March...

As Dave Collum tweeted, "That the Federal Reserve is explicitly stating their job is to support the asset markets, showing how unmoored to reality they have become. No price discovery? No fear of losing all credibility? No problem. That ship has sailed anyway. You guys are feckless."

* * *

Fed Chair Powell just attempted to explain how his 50bps rate-cut will 'ease' any fears (health, social, financial, economic).

“My colleagues and I took this action to help the U.S.economy keep strong in the face of new risks to the economic outlook.”

Powell started by saying that the fundamentals of the economy are strong, which is seriously unfortunate given it exposes his actions as purely market-driven. Remember, that's also what John McCain said on the day after the Lehman bankruptcy.

Powell says fundamentals “remain strong” but the spread of the coronavirus “has brought new challenges and risks.”

“We’ve come to the view now that it is time for us to act in support of the economy, and once you reach that decision, we decided to go ahead.”

Powell noted that the outbreak and measures to contain it will weigh on activity “for some time.”

“I don’t think anybody knows how long it will be.”

Powell on fiscal policy: Not our role, we have a full plate with monetary policy.

“We’re in active discussions with central banks around the world on an ongoing basis.”

Powell says G-7 statement was “a statement of general support” at a high level.

Powell, asked about possibility of more rate cuts, says:

“As I said in my statement, we’re prepared to use our tools and act appropriately depending on the flow of events.”

As Rabo noted earlier, in order to decide what to do after The Fed cut, answer this first, key question:

what level of interest rates is required to incentivize you to risk the death of yourself and your family?I am sure that there are policy wonks out there who believe they can correctly capture that precise equilibrium level on monetary policy. The point is that lower rates don’t help in this situation at all. If demand is destroyed by people bunkering down at home for weeks, and supply chains being disrupted, all lower borrowing costs can do is help tide businesses over if banks agree to extend loans and credit cards, etc.( as China is already now doing) – and all that does paint us further into the corner we are already in, because those rates won’t be able to rise again.Of course, if we don’t see any major fiscalstimulus then it’s hard to imagine how one can remain too optimistic either.

President Trump is demanding more though...

"The Federal Reserve iscutting but must further ease and, most importantly, come into line with other countries/competitors. We are not playing on a level field. Not fair to USA. It is finally time for the Federal Reserve to LEAD. More easing and cutting!"

Watch Live at 11amET:

* * *

Trump wins? ... but what is The Fed so afraid of?

Shortly after the G-7 meeting promised to do whatever it takes, and the biggest demand for Fed repo liquidity since the program began...

A desperate Fed has once again met market expectations, The Fed has just announced an emergency 50bps rate-cut.

The fundamentals of the U.S.economy remain strong. However, thecoronavirus poses evolving risks to economic activity.In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate by 1/2 percentage point, to 1 to 1‑1/4 percent.The Committee is closely monitoring developments and their implications for the economic outlook and will use its tools and act as appropriate to support the economy.

This is the largest rate-cut since the fall of 2008, and just the ninth emergency rate cut in history...

No comments:

Post a Comment