- THERE IS NO WAY ANY ECONOMY CAN HAVE IT BOTH WAYS, IE, JOBS-MANUFACTURING + FINANCIAL INSTITUTION.

- TRANSLATION: A GLOBAL CURRENCY (GNP) IS TOO EXPENSIVE AND OVERVALUED FOR DOMESTIC GDP MANUFACTURING AND SUBSEQUENT JOBS.

- SOLUTION: CRASH THE FEDERAL RESERVE CENTRAL BANK-GOVT.'S FREE PAPER CURRENCY WITH NEGATIVE BENCHMARK RATES AND TARIFF HIKES ON IMPORTS, WHICH WILL IN TURN RECOVER LOST US JOBS-MANUFACTURING AFTER 1970.

- OVER 200-COUNTRIES WILL LOOSE IN THEIR EXPORTS TO THE US.

- IN THE END ALL WILL BENEFIT AS "WEIGHTS & MEASURES" IS CONSTITUTIONALLY RESTORED AND PEGGED TO BULLION AND CRYPTOS.

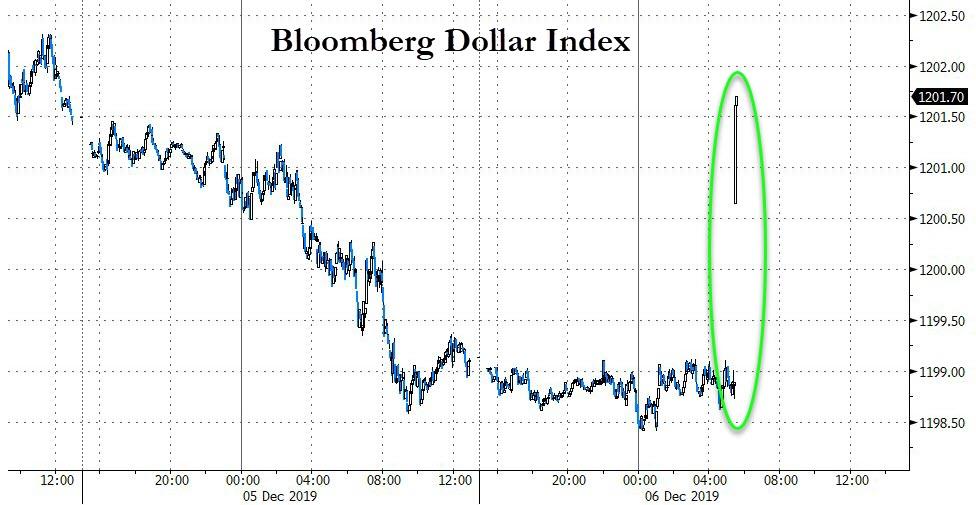

Stocks, Dollar, & Bond Yields Surge After Huge Jobs Beat

Following a much better than expected jobs gain in November, markets have reacted rather dramatically with bond yields and the dollar gapping higher and stocks jumping...

The dollar erased yesterday's drop...

Source: Bloomberg

And 30Y Yields are spiking back to the highs on Monday...

Source: Bloomberg

And as the dollar spikes, gold is hit...

Kudlow is due up next on CNBC so that should help too...

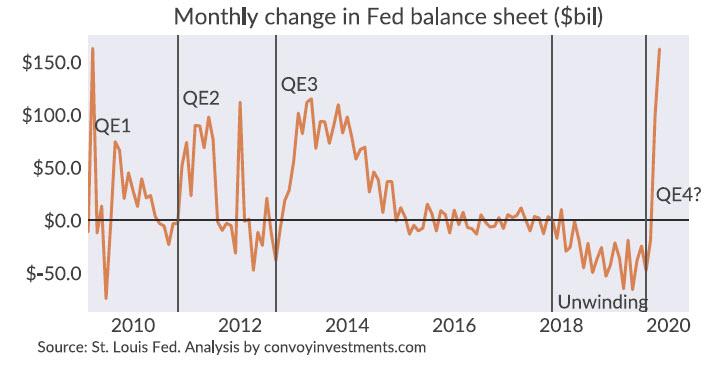

"The Fed Hasn't Expanded Its Balance Sheet At This Speed Since The Financial Crisis"

The Fed's balance sheet is expanding at a faster rate than during QE1, QE2 or QE3.

431 people are talking about this

* * *

Submitted by Howard Wang of Convoy Investments

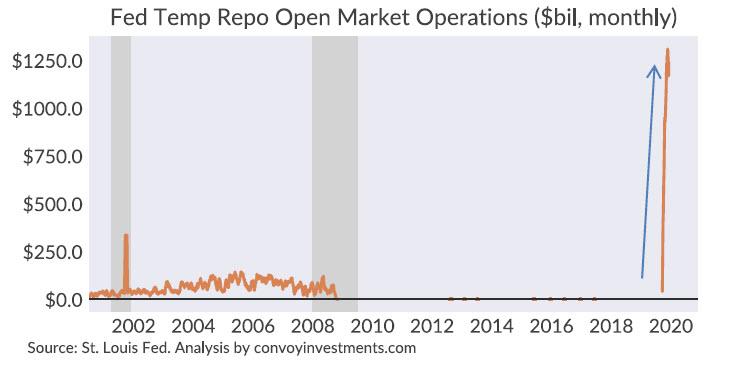

Has QE4 begun? The $1.2 trillion per month hole in the repo

In the two months since the repo repo

Below is the monthly rate of Fed open market purchases since 2000. In the era of QE and ample reserves, the Fed has not touched open market operations for more than 10 years before 2019. Prior to that, the highest rate of open market operations we

The planned QE unwinding has hit a brick wall and the Fed balance sheet is now expanding at a rate matched only briefly by QE1, and faster than QE2 or QE3.

Is this a temporary rescue of the repo

1. Pre‐2008, scarce reserves regime:

- Total reserves: small (<$50 billion)

- Excess reserves: none

- Interest on excess reserves: 0%

- Managing interest rates: to increase rates, Fed sells securities on the open market and reduces

supply - Banks: regulations are lax and risk tolerance is high

- Treasury

department

2. 2008‐2019, ample reserves regime:

- Total reserves: large ($trillions)

- Excess reserves: large ($trillions)

- Interest on excess reserves: positive at around Fed funds rate

- Managing interest rates: Because there is more reserves than the banks could possibly need, Fed sets interest rates by paying a floor rate on reserves.

- Banks: regulations are strict and risk tolerance is low

- Treasury

department

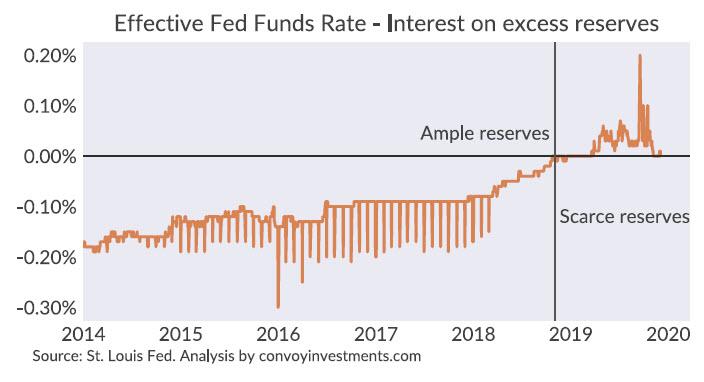

3. 2019 onwards, scarce reserves regime

- A combination of QE unwinding, strict banking regulations, and a concentration of reserves in a handful of banks have once again made reserves scarce, which means a rate floor is no longer effective at managing against rate rises. This was painfully obvious in December of 2018 and September of 2019. Thus far, the Fed has chosen their pre‐2008 strategy of temporary open market operations to manage rates in this new scarce reserves environment. But because the total pool of reserves is around 50 times larger now than pre‐2008, the size of the required open market operations is in the $trillions, not $billions, per month.

Going forward, the Fed must make a choice of staying in a regime of scarce reserves or going back to ample reserves. The Fed can lower interest on excess reserves and reduce bank incentives to hold excess reserves to some degree, but the new post‐2008 regulations will still necessitate a far larger base of reserves than pre‐2008. So managing a scarce reserves

Alternatively, the Fed can recognize that they’ve found the floor for the total amount of reserves necessary in our new regulatory environment and add some reserves via another round of QE as cushion

The key metric I’d keep an eye on is the difference between interest on excess reserves and the effective Fed Funds rate, which I show below. We made the switch from an ample reserves regime to a scarce reserves regime in December of 2018.

If the system has more than enough reserves, the effective Fed Funds rate would be below the interest on excess reserves because not every participant is eligible for interest on excess reserves, hence they’d push the average Fed Funds rate below interest on excess reserves. In the 2019 environment of scarce reserves, market participants are starved for reserves and bid the average Fed Funds rate at or above interest on excess reserves. At the moment, the Fed has done enough open market operations to meet reserve demand and drive Fed Funds rate exactly back to

Going forward, whether the Fed pushes effective Fed Funds rate below interest on excess reserves will signal the next era of monetary policy. If the Fed chooses the scarce reserves route, Fed funds rate Fed Funds rate further flattening

Unless banking regulations change dramatically, my guess is that QE4 is coming. The Fed would rather have a cushion of ample reserves against unexpected repo ups

No comments:

Post a Comment