- 90% ARE CLUELESS ENJOYING WONDERLAND IN OVER 200-COUNTRIES UNDER THEIR DEEP STATE HANDLERS.

- TRUMP PUSHES FOR NEGATIVE RATES WITH JOB GENERATING TRADE WARS THAT MAY CRASH OVER 300-YEARS OF ZERO VALUE PONZI CURRENCIES.

- THE DEEP STATE COUNTERS WITH THEIR LAWFARE QUID PRO QUO IMPEACHMENT STUNT.

- AND THE WINNER IS: "WAIT AND SEE."

Fed Funds Rate History with Its Highs, Lows, and Charts

How Fed Rate Changes Have Changed Through History

/fed-funds-rate-history-highs-lows-3306135-FINAL-f0474d99f37146dda37c75b7670421cb.png)

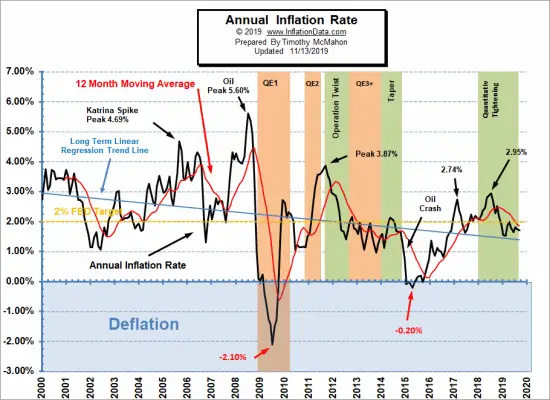

The Federal Reserve prefers to keep the fed funds rate in a 2% to 5% sweet spot that maintains a healthy economy. In this range, the nation's gross domestic product grows between 2% and 3% annually, and the natural unemployment rate is between 4.5% and 5%. Price increases remain below the Fed's inflation target of a 2% core rate. The fed funds rate was 1.75% as of October 30, 2019.

There were times in history when the nation's benchmark interest rate was well above this sweet spot to curb runaway inflation. Between 2008 and 2015, it was well below the target to stimulate economic growth. Once you see how the Fed changed the fed funds rate, you will understand how it managed both inflation and recession.

Highest Fed Funds Rate

The fed funds rate reached a high of 20% in 1979 and 1980 to combat double-digit inflation. The inflation began in 1973 after President Richard Nixon disengaged the dollar from the gold standard. Inflation tripled from 3.9% to 9.6%. The Fed doubled interest rates from 5.75% to a high of 11%. Inflation continued to remain in the double digits through all of 1974. It lasted until April 1975. The Fed kept raising the fed funds rate to a peak of 13% in July 1974. It dramatically lowered the rate to 7.5% in January 1975.

These sudden changes, known as stop-go monetary policy, confused businesses. They kept prices high to stay ahead of the Fed's interest rate spikes. That only made inflation worse. Fed leaders learned that managing inflation expectations was a critical factor in controlling inflation itself.

In 1979, Federal Reserve chair Paul Volcker ended the Fed's stop-go policy. He raised rates and kept them there to finally end inflation. That created the 1980 recession but thoroughly ended double-digit inflation. It hasn't been a threat since.

Lowest Fed Funds Rate

The all-time low was 0.25%. That's effectively zero. The Fed lowered it to this level on December 17, 2008. It was the 10th rate cut in a little more than a year. The Fed didn't resume raising rates until December 2015.

Before this, the lowest fed funds rate was 1% in 2003 to combat the 2001 recession. At the time, there were fears that the economy was drifting toward deflation.

Fed Funds Rate History

The charts below show the targeted fed funds rate changes since 1971. Until October 1979, the Federal Open Market Committee didn't announce its target interest rate after meetings. The target rate was inferred by an archived chart published by the Federal Reserve Bank of New York. The bank adjusted the rate through open market operations. As a result, the rates changed gradually, even in between meetings. Businesses were forced to guess what the rates would be. The Fed tried to fight inflation without managing the expectations of inflation.

In 1979, the Fed began targeting the money supply to fight inflation. As a result, the fed funds rate fluctuated a great deal between 1979 and 1982. In 1982, the Fed returned to targeting the fed funds rate specifically.

In February 1994, the FOMC formally announced its policy changes for the first time. Since then, its announcements make it clear what it wants the interest rate to be. This manages expectations of inflation. It minimizes disruptions caused by surprises from the Fed.

The Federal Reserve Bank of St. Louis publishes a complete history of the effective fed funds rate since 1954. The Fed also has transcripts of all meetings since 1936.

Fed Chair: Arthur Burns January 1970—March 1978

1971: GDP = 3.3%, Unemployment = 6.0%, Inflation = 3.3%

| Date | Fed Funds Rate | Event |

|---|---|---|

| Jan 12 | 4.25% | Expansion |

| Feb 9 | 3.75% | Expansion |

| Mar 9 | 5.0% | Inflation at 4.4% year-over-year |

| Jul 27 | 5.5% | Nixon shock; Weakened gold standard; Tariffs |

| Aug 24 | 5.75% | Wage-price controls |

| Oct 19 | 5.25% | Fed lowered rate to boost growth |

| Nov 16 | 5.0% | Fed lowered rate to boost growth |

1972: GDP = 5.3%, Unemployment = 5.2%, Inflation = 3.4%

| Mar 21 | 5.5% | Nixon devalued dollar, creating inflation |

| Dec 19 | 5.75% | Fed raised rate to combat 3.5% YOY inflation |

1973: GDP = 5.6%, Unemployment = 4.9%, Inflation = 8.7%

| Jan 16 | 6.0% | Fed raised rates to combat 3.6% inflation |

| Feb 13 | 6.5% | Fed raised rates to combat 3.6% inflation |

| Mar 20 | 7.0 | Fed raised rates to combat 3.6% inflation |

| Apr 17 | 7.25% | Inflation at 5.1% |

| May 15 | 7.5% - 7.75% | Inflation at 5.5% |

| Jun 19 | 8.5% | Inflation at 6.0% |

| Jul 17 | 10.25% | Inflation at 6.0% |

| Aug 21 | 11.0% | OPEC embargo worsened inflation in October |

1974: GDP = -0.5%, Unemployment = 7.2%, Inflation = 12.3%

| Feb 20 | 9.0% | Recession had begun in November 1973 |

| Mar 18 | 10.0% | Embargo ended in March |

| Apr 16 | 11.0% | Fed raised rates to stop inflation |

| Jul 16 | 13.0% | Inflation at 11.5%, Ford replaced Nixon in August |

| Nov 19 | 9.25% | Fed lowered rates to end recession despite 12% YOY inflation |

| Dec 17 | 8.0% | Fed lowered rates to end recession despite 12% YOY inflation |

1975: GDP = -0.2%, Unemployment = 8.2%, Inflation = 6.9%

| Jan 21 | 7.0% | Stagflation |

| Feb 19 | 6.0% | Economy contracted 4.8% in first quarter with inflation at 11.2% |

| Mar 18 | 5.75% | Recession ended |

| Apr 15 | 5.25% | Inflation at 10.2% |

| Jun 17 | 6.25% | Inflation at 9.2% |

| Sep 16 | 6.5% | Inflation falls to 7.9% |

1976: GDP = 5.4%, Unemployment = 7.8%, Inflation = 4.9%

| Jan 20 | 4.75% | Rate lowered from October through January |

| May 18 | 5.5% | Raised in April and May |

| Oct 19 | 5.0% | Official end of gold standard |

| Nov 16 | 4.75% | Lowered from July–November |

1977: GDP = 4.6%, Unemployment = 6.4%, Inflation = 6.7%

| Aug 16 | 6.0% | Inflation rises to 7% in April |

| Sep 10 | 6.25% | Inflation at 6.4% |

| Oct 18 | 6.5% | Raised again in September and October |

Fed Chair William Miller (March 1978—August 1979)

1978: GDP = 5.5%, Unemployment = 6.0%, Inflation = 9.0%

| Jan 17 | 6.75% | Inflation rises to 6.8% |

| Apr 18 | 7.0% | |

| May 16 | 7.5% | |

| Jun 20 | 7.75% | |

| Aug 15 | 8.0% | Inflation rises to 7.9% |

| Sep 19 | 8.5% | |

| Oct 17 | 9.0% | Inflation at 8.9% |

| Nov 21 | 9.75% | |

| Dec 19 | 10.0% | Raised each month from April through December |

Fed Chair Paul Volcker (August 1979—August 1987)

1979: GDP = 3.2%, Unemployment = 6.0%, Inflation = 13.3%

| Apr 17 | 10.25% | Inflation at 10.5% |

| Jul 11 | 10.5% | |

| Aug 14 | 11.0% | |

| Sep 18 | 11.5% | Inflation rises to 11.9% |

| Oct 6 | 13.0% | The Fed began targeting the money supply |

| Oct 22 | 15.5% | Conference call raised rates 2.5 points |

| Nov 20 | 14.0% | Inflation at 12.6% |

1980: GDP = -0.3%, Unemployment = 7.2%, Inflation = 12.5%

| Feb 5 | 15.0% | Recession began in January, Inflation at 14.6% |

| Mar 18 | 20.0% | |

| May 20 | 11.5% | Conference calls on April 29 and May 6 lowered rates |

| Jun 5 | 8.5% | Recession ends in July |

| Aug 12 | 10.0% | Raised rates back up, Inflation at 12.9% |

| Sep 16 | 11.0% | |

| Oct 21 | 12.0% | |

| Nov 18 | 18.0% | Inflation eases to 12.6% |

| Dec 12 | 20.0% | Conference call |

| Dec 19 | 18.0% | Lowered two points |

1981: GDP = 2.5%, Unemployment = 8.5%, Inflation = 8.9%

| Feb 3 | 20.0% | Reagan took office; Volcker raised rates again |

| Apr 28 | 16.0% | Conference call lowered rates |

| May 18 | 20.0% | Recession began in July |

| Nov 17 | 13.0% | Gradually lowered rates over 6 months |

| Dec 22 | 12.0% | Inflation at 8.9% |

1982: GDP = -1.8%, Unemployment = 10.8%, Inflation = 3.8%

| Mar 30 | 15.0% | Gradually raised rates 3 points over 4 months |

| Jul 15 | 13.0% | Conference call; Gradually lowered rates |

| Aug 24 | 9.5% | Gradually lowered rates |

| Nov 16 | 9.0% | Recession ends |

| Dec 21 | 8.5% | Inflation at 3.8% |

1983: GDP = 4.6%, Unemployment = 8.3%, Inflation = 3.8%

| May 2 | 49.5% | Gradually raised rates over 5 months |

| Aug 23 | 9.66% | Raised from May to August |

| Oct 4 | 9.25% | Lowered from August to October |

1984: GDP = 7.2%, Unemployment = 7.3%, Inflation = 3.9%

| Mar 27 | 10.5% | Raised rates again |

| Jul 17 | 11.5%. | |

| Aug 21 | 11.75% | Raised from March to August |

| Oct 2 | 10% | Began lowering again |

| Nov 7 | 9.5% | |

| Dec 18 | 8.25% | Lowered from September to December |

1985: GDP = 4.2%, Unemployment = 7.0%, Inflation = 3.8%

| Mar 26 | 9.0% | Raised from February to mid-March |

| May 21 | 7.75% | Began lowering again |

| Aug 20 | 8.0% | Raised again |

| Dec 17 | 7.75% | Lowered again |

1986: GDP = 3.5%, Unemployment = 6.6%, Inflation = 1.1%

| Apr 1 | 6.75% | Continued lowering rates |

| Aug 19 | 5.66% | Lowered until August |

| Dec 16 | 6.0% | Began raising rates again |

Fed Chair Alan Greenspan (August 1987—January 2006)

1987: GDP = 3.5%, Unemployment = 5.7%, Inflation = 4.4%

| May 19 | 6.75% | Continued raising rates to fight inflation |

| Sept 22 | 7.25% | Continued raising rates to fight inflation |

| Oct 19 | 6.75% | Lowered after Black Monday stock market crash |

1988 : GDP = 4.2%, Unemployment = 5.3%, Inflation = 4.4%

| Feb 10 | 6.5% | Continued lowering |

| Mar 29 | 7.5% | Began raising to fight inflation |

| Aug 16 | 8.25% | Began raising to fight inflation |

| Dec | 9.75% | Began raising to fight inflation |

1989: GDP = 3.7%, Unemployment = 5.4%, Inflation = 4.6%

1990: GDP = 1.9%, Unemployment = 6.3%, Inflation = 6.1%

| Jul 13 | 8.0% | Recession began in July |

| Oct 29 | 7.75% | Continued lowering rates to boost economy despite inflation |

| Nov 13 | 7.5% | Continued lowering rates to boost economy despite inflation |

| Dec 7 | 7.25% | Conference call |

| Dec 18 | 7.0% | Economy contracted 3.6% in Q4 |

1991: GDP = -0.1%, Unemployment = 7.3%, Inflation = 3.1%

| Jan 9 | 6.75% | Economy contracted 1.9% |

| Feb 1 | 6.25% | |

| Mar 8 | 6.0% | Recession ended |

| Apr 30 | 5.75% | Conference call |

| Aug 6 | 5.5% | |

| Sep 13 | 5.25% | Conference call |

| Oct 31 | 5.0% | Conference call |

| Nov 6 | 4.75% | Fed continued lowering rates to fight unemployment |

| Dec 6 | 4.5% | Fed continued lowering rates to fight unemployment |

| Dec 20 | 4.0% | Fed continued lowering rates to fight unemployment |

1992: GDP = 3.5%, Unemployment = 7.4%, Inflation = 2.9%

| Apr | 3.75% | Fed lowered rates to fight unemployment |

| Jul 1 | 3.25% | Fed lowered rates to fight unemployment |

| Aug 18 | 3.0% | Fed lowered rates to fight unemployment |

1993: GDP = 2.8%, Unemployment = 5.5%, Inflation = 2.7%.

- Clinton took office in 1993. Fed made no changes.

1994: GDP = 4.0%, Unemployment = 5.5%, Inflation = 2.7%

Feb 4 | 3.25% | Fed raised rates to keep economy healthy |

| Mar 22 | 3.5% | |

| Apr 18 | 3.75% | Conference call |

| May 17 | 4.25% | |

| Aug 16 | 4.75% | |

| Nov 15 | 5.5% | Raised rates |

1995: GDP = 2.7%, Unemployment = 5.6%, Inflation = 2.5%

| Feb 1 | 6.0% | Raised rates |

| Jul 6 | 5.75% | Lowered rates |

| Dec 19 | 5.5% |

1996: GDP = 3.8%, Unemployment = 5.4%, Inflation = 3.3%

| Jan 31 | 5.25% | Kept rates low despite inflation |

1997: GDP = 4.4%, Unemployment = 4.7%, Inflation = 1.7%

| Mar 25 | 5.5% | Raised rates despite low inflation |

1998: GDP = 4.5%, Unemployment = 6%, Inflation = 1.6%

1999: GDP = 4.8%, Unemployment = 6%, Inflation = 2.7%

| Jun 30 | 5.0% | Raised rates since economy was doing well |

| Aug 24 | 5.25% | |

| Nov 16 | 5.5% |

2000: GDP = 4.1%, Unemployment = 6%, Inflation = 3.4%

| Feb 2 | 5.75% | Raised rates despite stock market decline in March |

| Mar 21 | 6.0% | Raised rates despite stock market decline in March |

| May 16 | 6.5% | Raised rates despite stock market decline in March |

2001: GDP = 1.0%, Unemployment = 6%, Inflation = 1.6%

| Jan 3 | 6.0% | Bush took office |

| Jan 31 | 5.5% | Bush took office |

| Mar 20 | 5.0% | Recession began; Fed lowered rates to fight it |

| Apr 18 | 4.5% | Recession began; Fed lowered rates to fight it |

| May 15 | 4.0%^ | Recession began; Fed lowered rates to fight it |

| Jun 27 | 3.75% | EGTTRA tax rebate enacted |

| Aug 21 | 3.5% | |

| Sep 17 | 3.0% | 9/11 attacks |

| Oct 2 | 2.5% | Afghanistan War |

| Nov 6 | 2.0% | Recession ended |

| Dec 11 | 1.75% |

2002: GDP = 1.7%, Unemployment = 6%, Inflation = 2.4%

| Nov 6 | 1.25% | Fed lowered rates to fight sluggish growth |

2003: GDP = 2.9%, Unemployment = 6%, Inflation = 1.9%

2004: GDP = 3.8%, Unemployment = 6%, Inflation = 3.3%

| Jun 30 | 1.25% | Low rates pushed interest-only loans |

| Aug 10 | 1.5% | Helped cause Subprime Mortgage Crisis |

| Sep 21 | 1.75% | Helped cause Subprime Mortgage Crisis |

| Nov 10 | 2.0% | Helped cause Subprime Mortgage Crisis |

| Dec 14 | 2.25% | Helped cause Subprime Mortgage Crisis |

2005: GDP = 3.5%, Unemployment = 6%, Inflation = 3.4%

| Feb 2 | 2.5% | Hurt borrowers of adjustable loans when rates reset in 3rd year |

| Mar 22 | 2.75% | Hurt borrowers of adjustable loans when rates reset in 3rd year |

| May 3 | 3.0% | Hurt borrowers of adjustable loans when rates reset in 3rd year |

| Jun 30 | 3.25% | |

| Aug 9 | 3.5% | |

| Sep 20 | 3.75% | |

| Nov 1 | 4.0% | |

| Dec 13 | 4.25% |

Fed Chair Ben Bernanke (February 2006—January 2014)

2006: GDP = 2.9%, Unemployment = 6%, Inflation = 2.5%

| Jan 31 | 4.5% | Raised to cool housing market bubble; More homeowners default |

| Mar 28 | 4.75% | Raised to cool housing market bubble; More homeowners default |

| May 10 | 5.0% | Raised to cool housing market bubble; More homeowners default |

| Jun 29 | 5.25% | Raised to cool housing market bubble; More homeowners default |

2007: GDP = 1.9%, Unemployment = 6%, Inflation = 4.1%

2008: GDP = -0.1%, Unemployment = 6%, Inflation = 0.1%

| Jan 22 | 3.5% | |

| Jan 30 | 3.0% | Tax rebate |

| Mar 18 | 2.25% | Bear Stearns bailout |

| Apr 30 | 2.0% | Lehman fails; Bank bailout approved; AIG bailout |

| Oct 8 | 1.5% | Lehman fails; Bank bailout approved; AIG bailout |

| Oct 29 | 1.0% | Lehman fails; Bank bailout approved; AIG bailout |

| Dec 16 | 0.25% | Effectively zero; Lowest fed fund rates possible |

Between 2008 and 2015, the Fed kept the rate at zero. The recession ended in June 2009.

Fed Chair Janet Yellen (February 2014—February 2018)

2015: GDP = 2.9%, Unemployment = 6%, Inflation = 0.7%

| Dec 17 | .0.5% | Growth stabilized so Fed began raising rates |

2016: GDP = 1.6%, Unemployment = 4.6%, Inflation = 2.1%

| Dec 15 | 0.75% | Fed maintained steady increase in rates |

2017: GDP = 2.4%, Unemployment = 4.1%, Inflation = 2.1%

| Mar 16 | 1.0% | Fed was steady on its path of normalizing its benchmark rate |

| Jun 15 | 1.25% | Fed was steady on its path of normalizing its benchmark rate |

| Dec 14 | 1.5% | Fed was steady on its path of normalizing its benchmark rate |

Fed Chair Jerome Powell (Since February 2018)

2018: GDP = 2.9%, Unemployment = 3.9%, Inflation = 1.9%

| Mar 22 | 1.75% | Fed projects steady growth |

| Jun 14 | 2.0% | Fed projects steady growth |

| Sep 27 | 2.25% | Fed projects steady growth |

| Dec 19 | 2.5% | Fed promised to stop raising rates |

2019: Q3 GDP = 1.9%, Sep Unemployment = 3.5%, Sep Inflation = 1.7%

| Jul 31 | 2.25% | Fed lowered rate despite steady growth |

| Sep 18 | 2.0% | Fed was concerned about slowing growth. |

| Oct 30 | 1.75% | Slow global growth and muted inflation. |

No comments:

Post a Comment